Mango Network: A Transactional Omni-Chain Backbone Leads Omni-Chain Evolution in 2024

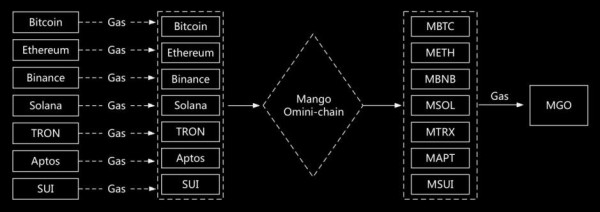

- Mango public chain is coming soon, enabling seamless transfer of tokens, NFTs, data and information between heterogeneous L1/L2 public chains.

- The fragmented crypto assets and liquidity mining pools of different chains achieve efficient Omni-chain circulation through Mango.

- Mango’s Omni-chain application gives birth to an omni-chain liquidity pool, providing new possibilities for Web3 and DeFi innovation.

In 2023, the global blockchain landscape saw a shift from bear to bull market. The year’s stories included the rise of Layer 2 networks, the launch of new public chains backed by Move language, the cross-chain competition led by LayerZero, and the breakout of the BRC20 inscription MEME tokens. As more users entered the space and the industry’s ecosystem of use cases expanded, multi-chain users increasingly demanded seamless cross-chain interaction. On the other hand, the industry as a whole began to realize that building an omni-chain infrastructure is the most direct and effective way to break the blockchain trilemma. The omni-chain narrative is becoming the industry’s theme, leading to a new round of paradigm shifts in 2024.

In the face of industry pain points, Mango Network ($MGO) takes the lead and becomes the industry’s first Layer1 new public chain positioned as a transactional omni-chain infrastructure network. By building an all-in-one liquidity service omni-chain network, it brings users a more secure, trustworthy, asset-diverse, and convenient self-governing omni-chain trading experience.

Move-based and inherently safe

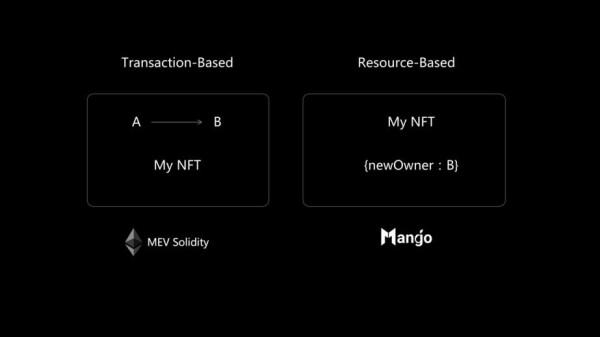

More than just a programming language for crypto assets, the Move language is a valuable legacy of Facebook’s super-sovereign cryptocurrency project Libra, which bridges the gap between Solidity and EVM and offers a high-performance, secure, and reliable smart contract programming environment for blockchain applications.

Mango Move is a statically typed programming language with multi-threading capabilities that can effectively reduce concurrency situations. The combination of a static language with smart contracts provides a secure environment for application development, where the project source code is not tampered with in the event of an attack. Moreover, the Move language treats digital assets as first-class citizens, specifically defining Token as an independent resource category (Resource) to distinguish it from other data. The asset transfer of Mango Move is object transfer, ensuring the uniqueness and security of assets, and adding more security for on-chain DeFi projects.

Modularity leads to high performance, breaking the impossible triangle

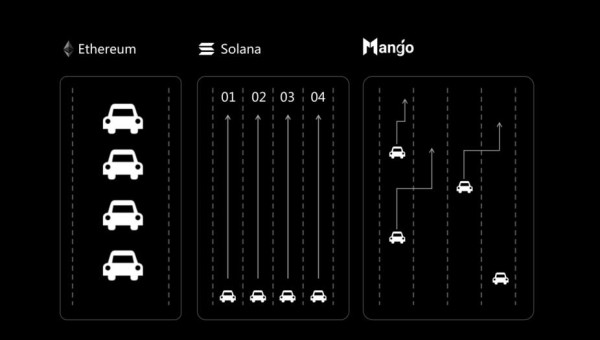

Based on the Mango Move language, the Mango modular blockchain decomposes blockchain functionality into different levels of network architecture, achieving high security, high performance, and low cost, and breaking the “impossible triangle” of decentralized networks.

Traditional blockchain systems usually integrate functions such as consensus, settlement, data availability, and execution in a single architecture, which will not be able to meet the requirements of different scenarios as the complexity and demands of blockchain applications increase.

The Mango modular blockchain separates these core functions so that individual functional modules can operate independently while maintaining collaboration with each other. This architecture makes the blockchain system more flexible and scalable, allowing for customization and optimization based on different needs.

Through features such as horizontal scalability, composability, and on-chain storage, Mango Network can achieve over 100,000 TPS of parallel transaction processing and sub-second settlement. It also supports a wide range of on-chain assets and solves the common pain points of L1 with unparalleled speed and low cost, bringing developers and users an amazing user experience.

Born as an omni-chain, pioneering new paradigms for applications

As a L1 public chain positioned as enabling omni-chain application, Mango’s biggest advantage is that it can serve as an efficient execution layer and settlement layer, allowing developers to design applications from the perspective of omni-chain interoperability. Users can interactive with on-chain applications through any L1 and L2 chains, significantly reducing the complexity of user operations.

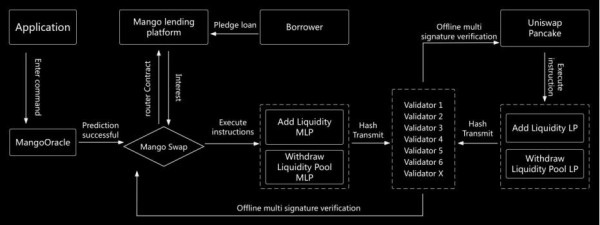

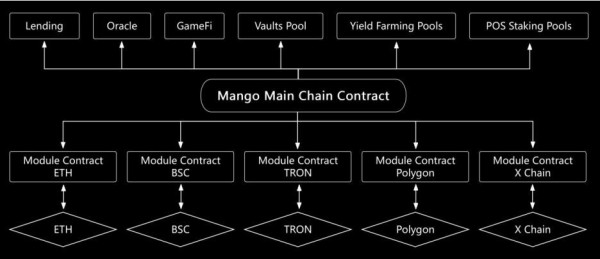

The technical architecture of Mango’s omni-chain application consists of Mango main chain contracts and module contracts. The main logic of the application is stored in the Mango main chain, implementing “central control”. Then, remote access modules are deployed on other chains to interact with end users, obtain user input, and output the desired results.

For example, DEX developers can deploy dApps on the Mango main chain. Users can operate the application from the Mango main chain and also perform operations on any other chain through remote access modules, just as convenient as accessing local programs. This also means that users only need to prepare one kind of Token as Gas, and do not need to know which chain the dApp is actually deployed on, in order to realize any cross-chain operations.

The biggest advantage of Mango’s omni-chain application technology architecture is that it significantly reduces the complexity of cross-chain integration. When the main logic of the program is processed on the Mango main chain, the application has a unified state record. After the user deploys the contract on a new chain, they can inherit all the state records and liquidity from the main chain of the entire network. Meanwhile, when other applications integrate this program, they only need to connect on the main chain to access all its features and liquidity.

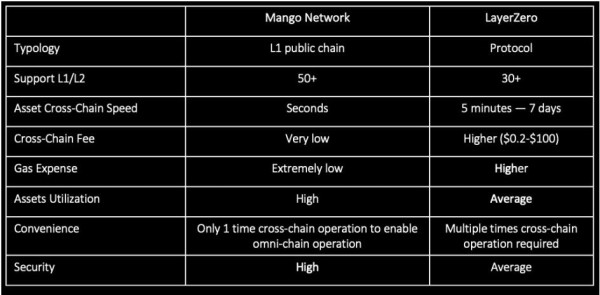

Compared to cross-chain protocols like LayerZero, Mango’s omni-chain application does not require frequent asset cross-chain operations between different blockchains, resulting in lower costs, faster confirmations, and higher efficiency. At the same time, the omni-chain transaction does not require storing assets or data in a third-party institution, thus ensuring a higher level of asset security.

The omni-chain application realizes the perfect connection of heterogeneous blockchains, solves the multiple pain points of Web3 application and DeFi protocols, such as user experience and liquidity fragmentation, and builds a one-stop liquidity service network through the main-chain contract and modular contract, delivering a unique transaction experience for users.

The omni-chain liquidity pool promotes DeFi innovation

Mango’s omni-chain application makes it possible to support a omni-chain liquidity pool. In the past, DeFi projects needed to setup liquidity pools separately on each public chain, which reduced capital efficiency and increased the complexity of cross-chain operations for users. Based on the Mango omni-chain application, it is now possible to build a “one-stop liquidity pool” that supports omni-chain assets and achieves omni-chain operations.

Mango’s liquidity service network has the following advantages:

- Unified user experience: Users can access DeFi applications on other chains through the unified entrance of the Mango chain.

- Low cost: The process fees for asset cross-chain transactions are extremely low through Mango Network, and the gas cost is even lower.

- High asset liquidity: Users only need to use one type of token as gas fees to freely transfer assets between different chains.

- Efficient and secure: Developed based on the Move language, it has inherent security advantages.

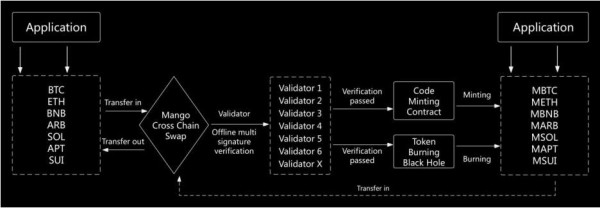

Users can transfer on-chain assets to the liquidity pool deployed on the Mango main chain through the Mango Network, and then participate in DeFi operations on any chain through the module contracts deployed on the target chain. In that way, it reduces the complexity of cross-chain operations, improves security, and lowers the user’s Gas consumption without transactional loss.

For example, users can cross-chain their ETH assets to the liquidity pool on the Mango main chain and interact with Pancake Swap on the BNB chain through Mango’s module contract on the target chain. This means that users who only hold a single token asset such as BTC or ETH can also participate in DeFi projects on any chain, dramatically increasing the potential TVL of the liquidity pool, thus driving DeFi innovations such as omni-chain liquidity lending, omni-chain staking, next-generation flash loans, and brand new algorithmic stablecoins.

For example, the omni-chain liquidity lending is based on the single-coin pool of each public chain, with Mango Network as the bridge and settlement layer, and the single-coin pool of each public chain allows users from any chain to provide liquidity for the protocol. Compared to Aave, which setups liquidity pools on each target chain and uses third-party cross-chain bridge for cross-chain transactions, all operations of Mango’s omni-chain liquidity lending can be conducted on any chain, which will significantly enhance the capital efficiency of the leading protocol.

BeingDex, an innovative omni-chain order matching trading platform

BeingDex is a decentralized exchange developed based on Mango Move, supporting on-chain order matching, with prominent innovations, such as wallet-to-wallet matching, order book mode, support for candlestick charts, and no need for liquidity pools.

This approach has significant differences from Uniswap V3. Order book trading can provide greater trading depth, bringing higher price transparency. Users can see all pending orders, making it easier for them to find the best trading price. At the same time, the Mango Move language uses static calls with unchangeable execution ordering, which can effectively protect against MEV attacks and help users further reduce trading slippage.

BeingDex supports on-chain assets, including tokens, NFTs, and inscriptions, and can bring on-chain liquidity into various Web3 applications as a liquidity gateway. The BeingDex team is constantly expanding the boundaries of services, providing users with one-stop asset management services through crypto wallet, DeFi, yield farming, POS staking pool, IDO, NFT trading platform, decentralized social applications, and DAO, among other Web3 key infrastructure.

Overall, the omni-chain transaction is an inevitable trend in the development of Web3 applications, which can improve asset liquidity, enhance capital efficiency, reduce transaction costs, expand application scenarios, and provide users with more convenient, efficient, and diverse services.

The emergence of Mango Network has brought new opportunities for the development of the blockchain industry. It is expected to become a leader in omni-chain interoperability and prepare for the industry’s paradigm shift as a transactional omni-chain infrastructure in the Web3 field.

Key points of the Mango Network Whitepaper

A. Positioning: Transactional Omni-chain Infrastructure

Keywords: L1 new public chain, DPoS, omni-chain application, Move language, modularization

B. Technical Highlights

1.Support for omni-chain applications – users only need to prepare one type of token as gas to achieve interaction and operation on various heterogeneous blockchains.

2.High performance – over 100,000 TPS, sub-second settlement, low gas fees, good user experience.

3.High security – Based on the Move language, a combination of static language and smart contracts, the project code will not be tampered with and can effectively resist attacks.

4.Modularization – The architecture that breaks down blockchain functions into multiple independent modules, where each module can focus on specific functions, such as consensus, execution, data availability, etc. It can be customized to meet the needs of different application scenarios. The modular blockchain has good scalability, and can be expanded by adding or deleting modules to meet the growing demand. At the same time, modularization can also improve security by decomposing different functions into different modules.

C. Implementation of Mango omni-chain application

Mango omni-chain application adopts the architecture design of main chain contract and module contracts, in which the main business logic will be deployed on Mango main chain to realize the function of “overall coordination”. On other public chains, remote access modules can be deployed to interact with end-users, such as obtaining input and output results.

The specific operation process is as follows. Users input through the remote module on the new chain, and the module transfers the input information across chains to the Mango main chain. After processing the main chain, the output result is returned to the corresponding remote module on the new chain. The module presents the user with a localized interactive experience in this way. In addition, to meet the expansion needs, certain functional modules within the main chain can also be deployed on other public chains to collectively form a virtual main chain system.

In general, this architectural design achieves the goal of cross-chain application interconnection through the abstraction and decoupling between the main chain and module contracts. Users can use omni-chain services distributed across multiple chains through a simple interactive interface, providing a more lightweight and unified experience.

D. Technical Advantages of Omni-chain Applications

It provides settlement layer and execution layer between heterogeneous public chains. Previously, users needed to use cross-chain bridges like LayerZero to transfer assets between heterogeneous chains, and they had to prepare corresponding tokens as gas on different chains. Now, users only need to migrate their assets to the Mango main chain through Mango’s own cross-chain bridge, and they can interact and operate on any target chain through module contracts. Compared to cross-chain bridges, omni-chain applications have significant advantages:

1.Easy to expand – The main logic of the program is processed on the Mango main chain, and the application has a unified state record. After deploying the contract on the new chain, users can inherit all the state records and liquidity from the main chain without reinventing the wheel.

2.Better user experience – Users don’t need to worry about which chain the program is deployed on and can access the application from any chain on the main chain, just like accessing a local program; they also don’t need to frequently use cross-chain bridges and only need one type of token as gas to operate and interact on any chain.

3.Easy cross-chain integration – when other applications integrate this program, they only need to connect on the main chain of the entire network to access all its features and liquidity.

E. Composition of Mango Public Chain Infrastructure Protocol

1.ZK Zero-Knowledge Proof – Achieving anonymous transactions, privacy protection, and cross-chain interoperability authentication

2.Distributed storage – using IPFS to store data, ensuring data redundancy, reliability, and scalability.

3.MgoDNS Domain Name Service – a solution based on cross-chain protocol for distributed domain names, providing domain name and domain name data analysis services for non-intermediated networks. MgoDNS is decentralized, with blockchain as its underlying layer and traditional internet as its upper layer. MgoDNS can also connect various types of public chains and consortium chains, collectively forming a super hub for connecting various blockchains.

4.Mango client – is a consistent replica that maintains the effective state of the system for auditing and building transactions or operational services.

F. Roadmap and Schedule

The testnet is scheduled to go live in March 2024, the mainnet is scheduled to go live in April-May 2024.

Being Wallet, BeingDex (order book-style omni-chain order matching trading platform), and other core applications is live now.

About Mango Network

Mango Network is a Layer 1 public chain based on the Move language, aiming to become a transactional omni-chain infrastructure network. It achieves omni-chain applications through modularity and builds a one-stop liquidity service network, providing users with a more secure, trustworthy, asset-diverse, convenient, and autonomous trading experience. MGO is its native token.

Mango Network was developed by MangoNet Labs, a technology company focused on Web3 infrastructure. Its vision is to help one billion users smoothly adopt Web3.

- Website: mangonet.io

- Github: https://github.com/MangoNetworkOs

- Twitter: https://twitter.com/MangoOS_Network

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Media Contact

Company Name: Goknews

Contact Person: Bella

Email: Send Email

Country: United States

Website: www.goknews.com