Electric Mid – and Large (9-14m) Bus Market Size, Share, Trends & Global Forecast by 2030

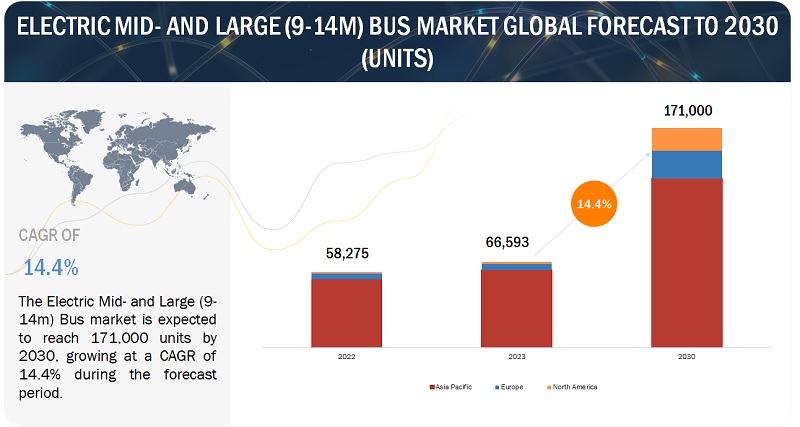

The global electric mid- & large bus market size is projected to grow from 66,593 units in 2023 and is expected to cross 171,000 units by 2030, at a CAGR of 14.4%.

Growing urbanization, population density, and government policies will influence the electric mid- & large bus market growth in the coming years. Reasons such as government incentives, policies promoting zero-emission public transit, advances in battery technology, and reducing costs with improved range would enhance the growth of electric mid- & large buses. However, the industry would face challenges such as high costs for developing charging infrastructures. Unlike many developed countries, insufficient charging infrastructure is one of the major challenges in the growth of the electric mid- & large buses market in developing countries, including India, South Korea, and others.

“The significance of electric mid- & large (9-14m) buses”

Electric mid- & large (9-14m) buses hold the largest share as most of the public transport fleets are incorporated with this category of bus length globally. This is mainly because this segment has a relatively larger seating capacity. These buses can generally travel up to 350 km on a single charge, which suits the intracity applications. The electric mid- & large (9-14m) buses are emerging as a crucial component of sustainable urban transportation. Their larger capacity caters to higher passenger volumes, enhancing public transportation efficiency and reducing traffic congestion. The optimal balance between battery size, chemistry, and passenger capacity in these buses effectively meets the demands of urban transportation while maintaining efficiency. These buses typically utilize advanced battery chemistries like NMC or LFP, balancing energy density and cycle life. This combination enables electric mid- & large (9-14m) buses to cater to a broader range of passenger needs, from intra-city routes to longer-distance intercity commutes, making them a popular choice for sustainable urban transportation solutions.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=234405016

“Fuel-cell electric mid- & large (9-14m) buses – Promising Market”

Fuel cell electric mid- & large buses are gaining traction as an eco-friendly alternative in public transportation. These buses boast longer ranges than their battery-electric counterparts, contributing to their appeal for intercity routes. With growing competition, the focus on improving fuel efficiency, durability, and the overall performance of fuel cell stacks would be enhanced. They offer a 300-500 km range and have shorter refueling time than diesel or electric mid- & large buses. Recent launches from manufacturers like Toyota, Hyundai, and Ballard Power Systems showcase advancements in fuel cell technology. In April 2022, Hyundai Motor Company (South Korea) announced the launch of its latest fuel-cell electric mid- & large bus, the Elec City Fuel Cell. This bus is designed to travel a range of up to 550 kilometers on a single charge. It is also one of the longest-range fuel-cell electric buses currently available.

Similarly, in September 2022, NFI Group Inc. announced the launch of its next-generation hydrogen fuel-cell electric Xcelsior CHARGE FC heavy-duty transit bus with a driving range of over 370 miles. As technology continues to mature and hydrogen infrastructure expands, fuel-cell electric mid- & large buses are poised to play a significant role in the future of sustainable urban transportation. However, it will remain a niche bus category due to the defined nature of transit bus usage and will primarily focus on the coach market at a global level.

“North America to be the fastest growing market for electric mid- & large (9-14m) buses during the forecast period.”

The North American region is one of the world’s most well-established electric mid- & large bus markets. It is the 3rd largest electric mid- & large bus market, running behind Asia Pacific and Europe. This region is speculated to remain the fastest-developing market by 2030. North America has major electric mid- & large bus manufacturers with solid footholds in R&D innovations and technological advancements. With government support through incentives, tax benefits, supportive policies, the presence of individual investors, and a technological edge, electric mid- & large bus adoption will be spurred. On January 2023, FTA announced the availability of nearly USD 1.7 billion in Fiscal Year 2023 funding to support state and local efforts to buy or modernize buses, improve bus facilities, and support workforce development. The US is the largest market in the region, which is focused on NMC batteries as they allow a capacity of up to 818 kWh that is better suited to the transit operators’ requirements and the more extensive operational needs.

Further, city/transit and school buses will have a promising growth opportunity in several cities and states in the US, including California, New York, and others. More than 50% of the electric mid- & large bus in North America are City/Transit buses, followed by School buses. School buses contribute a significant portion of the US bus segment, and around 45% of electrification is expected in this segment by 2030. Many states in the US have announced their ambition to implement electric mobility in the transport sector. For instance, the US Environmental Protection Agency’s (EPA) Clean School Bus Rebate Program has awarded over USD 900 million for more than 2,400 electric school buses to 389 school districts. California leads in electric school bus adoption, with over 1,800 committed electric buses across the state, at least 35% of which are delivered or operating.

Further, Canada established the Zero-Emission Transit Fund, which provides up to 75% of eligible costs for purchasing electric buses and associated charging infrastructure to support the electrification of public transit systems. Quebec in Canada has implemented an Electric and Hybrid Transportation Policy, which has set the target of 100% electrification of public transit by 2030. Thus, electrifying the entire fleet of US school buses would reduce greenhouse gas emissions by approximately eight megatons per year and reduce emissions from all US buses by 35% annually. Many more such government schemes and supportive policies are likely to be announced, which will poise the economic growth of the electric mid- & large bus market in the North American region.

Key Market Players:

The electric mid- & large (9-14m) buses market is dominated by established players such as BYD (China), Yutong (China), CAF (Solaris) (Spain), VDL Groep (Netherlands), and AB Volvo (Sweden).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=234405016

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/electric-mid-and-large-9-14m-bus-market-234405016.html