Hemophilia A Market Report 2034: Epidemiology Data, Pipeline Therapies, Latest FDA, EMA, PDMA Approvals by DelveInsight | BioMarin Pharmaceutical, Novo Nordisk, Sanofi/Alnylam Pharmaceuticals, Pfizer

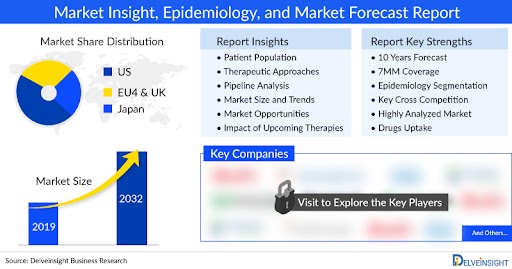

DelveInsight’s “Hemophilia A Market Insights, Epidemiology, and Market Forecast-2034″ report offers an in-depth understanding of the Hemophilia A, historical and forecasted epidemiology as well as the Hemophilia A market trends in the United States, EU5 (Germany, Spain, Italy, France, and United Kingdom) and Japan.

The Hemophilia A market report covers emerging drugs, current treatment practices, market share of the individual therapies, and current & forecasted market size from 2020 to 2034. It also evaluates the current treatment practice/algorithm, market drivers & barriers, and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

To Know in detail about the Hemophilia A market outlook, drug uptake, treatment scenario and epidemiology trends, Click here; Hemophilia A Market Insights

Some of the key facts of the Hemophilia A Market Report:

- The Hemophilia A market size was valued approximately USD 11,200 million in 2023 and is anticipated to grow with a significant CAGR during the study period (2020-2034)

- Several emerging treatments such as SPK-8011 (Roche [Spark Therapeutics]), fitusiran (Sanofi), Marstacimab (Pfizer), among others, are currently in development to provide safe and effective approved therapies.

- In December 2023, Pfizer revealed that the US FDA has approved Pfizer’s Biologics License Application (BLA) for marstacimab, based on findings from the Phase III BASIS trial for individuals with hemophilia A or hemophilia B lacking inhibitors to Factor VIII (FVIII) or Factor IX (FIX). Additionally, the European Marketing Authorization Application (MAA) for marstacimab has successfully passed validation and is presently under evaluation by the European Medicines Agency (EMA). The US FDA has scheduled a Prescription Drug User Fee Act (PDUFA) action date for the fourth quarter of 2024, with a decision from the European Commission (EC) expected by the first quarter of 2025.

- In December 2023, Roche has unveiled preliminary analysis findings from the Phase III HAVEN 7 clinical trial, demonstrating the efficacy of its bispecific factor IXa-directed and factor X-directed antibody, Hemlibra (emicizumab), in infants diagnosed with severe hemophilia A lacking factor VIII inhibitors, who were either previously untreated or minimally treated. This single-arm, descriptive trial is structured to assess the safety, efficacy, pharmacodynamics, and pharmacokinetics of subcutaneously administered Hemlibra in infants.

- The overall treated prevalent population of Hemophilia A in the Seven Major Markets (7MM) was estimated to be approximately 45,000 cases in 2023, with expectations for an increase during the study period.

- In the European Union Four (EU4) countries and the United Kingdom, France exhibited the highest prevalent population of Hemophilia A, with an estimated 7,000 cases, followed by the UK and Italy. Conversely, Spain recorded the lowest prevalent population of Hemophilia A in 2023.

- In a study conducted by Karen et al. (2022), it was found that the approximate prevalence of Hemophilia A is 24.6 cases per 100,000 males for all severities of the condition, with severe Hemophilia A being estimated at 9.5 cases per 100,000 males.

- Key Hemophilia A Companies: BioMarin Pharmaceutical, Novo Nordisk, Sanofi/Alnylam Pharmaceuticals, Pfizer, Sangamo Therapeutics, and others

- Key Hemophilia A Therapies: Valoctocogene Roxaparvovec, Concizumab, Fitusiran, Marstacimab, Efanesoctocogalfa, Giroctocogene fitelparvovec, and others

- The Hemophilia A epidemiology based on severity analyzed that severe cases of Hemophilia A are more prominent in comparison to mild and moderate cases

Hemophilia A Overview

Hemophilia A is a genetic bleeding disorder in which an individual lacks or has low levels of proteins named clotting factor VIII. Without enough factor VIII, the blood cannot clot properly to control bleeding. Although it is passed down from parents to children, about 1/3 of cases found have no previous family history.

Get a Free sample for the Hemophilia A Market Report:

https://www.delveinsight.com/report-store/hemophilia-a2030-market

Hemophilia A Market

The dynamics of the Hemophilia A market are anticipated to change in the coming years owing to the expected launch of emerging therapies and others during the forecasted period 2020-2034.

Hemophilia A Epidemiology

The epidemiology section provides insights into the historical, current, and forecasted epidemiology trends in the seven major countries (7MM) from 2020 to 2034. It helps to recognize the causes of current and forecasted trends by exploring numerous studies and views of key opinion leaders. The epidemiology section also provides a detailed analysis of the diagnosed patient pool and future trends.

Download the report to understand which factors are driving Hemophilia A epidemiology trends @ Hemophilia A Epidemiological Insights

Hemophilia A Epidemiology Segmentation:

The Hemophilia A market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Prevalence of Hemophilia A

- Prevalent Cases of Hemophilia A by severity

- Gender-specific Prevalence of Hemophilia A

- Diagnosed Cases of Episodic and Chronic Hemophilia A

Hemophilia A Drugs Uptake and Pipeline Development Activities

The drugs uptake section focuses on the rate of uptake of the potential drugs recently launched in the Hemophilia A market or expected to get launched during the study period. The analysis covers Hemophilia A market uptake by drugs, patient uptake by therapies, and sales of each drug.

Moreover, the therapeutics assessment section helps understand the drugs with the most rapid uptake and the reasons behind the maximal use of the drugs. Additionally, it compares the drugs based on market share.

The report also covers the Hemophilia A Pipeline Development Activities. It provides valuable insights about different therapeutic candidates in various stages and the key companies involved in developing targeted therapeutics. It also analyzes recent developments such as collaborations, acquisitions, mergers, licensing patent details, and other information for emerging therapies.

To know more about Hemophilia A treatment, visit @ Hemophilia A Medications

Hemophilia A Therapies and Key Companies

- Valoctocogene Roxaparvovec: BioMarin Pharmaceutical

- Concizumab: Novo Nordisk

- Fitusiran: Sanofi/Alnylam Pharmaceuticals

- Marstacimab: Pfizer

- Efanesoctocogalfa: Sanofi

- Giroctocogene fitelparvovec: Sangamo Therapeutics / Pfizer

Hemophilia A Market Strengths

- Hemophilia A market has a diverse pipeline such as extended half-life therapies, siRNA, bispecific antibodies, Tissue factor pathway inhibitors, and gene therapy which in coming year boast the hemophilia A market.

- Pipeline therapies come with a convenient patient route of administration and are also expected to decrease the treatment duration and increase the patient compliance.

Hemophilia A Market Opportunities

- The severe segment mainly dominates the market (~55% cases), and very limited treatment options are available, thus providing potential lucrative market opportunities.

- Current therapies are associated with side effects, and there is still a scope of drugs with better safety profiles, ultimately leading to better Quality of Life (QoL)

Scope of the Hemophilia A Market Report

- Study Period: 2020–2034

- Coverage: 7MM [The United States, EU5 (Germany, France, Italy, Spain, and the United Kingdom), and Japan]

- Key Hemophilia A Companies: BioMarin Pharmaceutical, Novo Nordisk, Sanofi/Alnylam Pharmaceuticals, Pfizer, Sangamo Therapeutics, and others

- Key Hemophilia A Therapies: Valoctocogene Roxaparvovec, Concizumab, Fitusiran, Marstacimab, Efanesoctocogalfa, Giroctocogene fitelparvovec, and others

- Hemophilia A Therapeutic Assessment: Hemophilia A current marketed and Hemophilia A emerging therapies

- Hemophilia A Market Dynamics: Hemophilia A market drivers and Hemophilia A market barriers

- Competitive Intelligence Analysis: SWOT analysis, PESTLE analysis, Porter’s five forces, BCG Matrix, Market entry strategies

- Hemophilia A Unmet Needs, KOL’s views, Analyst’s views, Hemophilia A Market Access and Reimbursement

Discover more about therapies set to grab major Hemophilia A market share @ Hemophilia A market forecast

Table of Contents

1. Hemophilia A Market Report Introduction

2. Executive Summary for Hemophilia A

3. SWOT analysis of Hemophilia A

4. Hemophilia A Patient Share (%) Overview at a Glance

5. Hemophilia A Market Overview at a Glance

6. Hemophilia A Disease Background and Overview

7. Hemophilia A Epidemiology and Patient Population

8. Country-Specific Patient Population of Hemophilia A

9. Hemophilia A Current Treatment and Medical Practices

10. Hemophilia A Unmet Needs

11. Hemophilia A Emerging Therapies

12. Hemophilia A Market Outlook

13. Country-Wise Hemophilia A Market Analysis (2020–2034)

14. Hemophilia A Market Access and Reimbursement of Therapies

15. Hemophilia A Market Drivers

16. Hemophilia A Market Barriers

17. Hemophilia A Appendix

18. Hemophilia A Report Methodology

19. DelveInsight Capabilities

20. Disclaimer

21. About DelveInsight

About DelveInsight

DelveInsight is a leading Healthcare Business Consultant, and Market Research firm focused exclusively on life sciences. It supports Pharma companies by providing comprehensive end-to-end solutions to improve their performance.

It also offers Healthcare Consulting Services, which benefits in market analysis to accelerate the business growth and overcome challenges with a practical approach.

Media Contact

Company Name: DelveInsight

Contact Person: Gaurav Bora

Email: Send Email

Phone: +14699457679

Address:304 S. Jones Blvd #2432

City: Albany

State: New York

Country: United States

Website: https://www.delveinsight.com/